Quantitative import restrictions are seldom imposed except on a limited range of products for the protection of local industries or reasons of security. On 3 December 2015 the Inland Revenue Board of Malaysia IRBM published Public Ruling PR No.

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Seventeen percent of Malaysias tariff lines principally in the construction equipment agricultural mineral and motor vehicle sectors are also subject to.

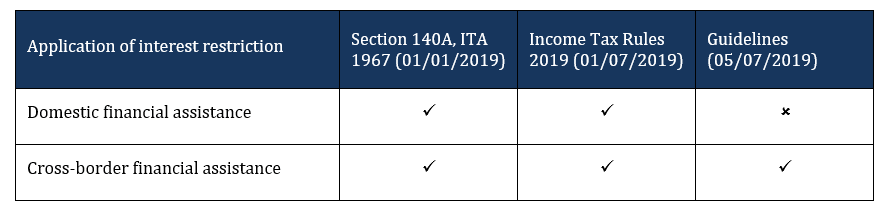

. Guidelines for Restriction on Deductibility of Interest under Section 140C Introduction Further to the release of Income Tax Restriction on Deductibility of Interest Rules 2019 the ESR Rules as reported in our Special Alert 2. We will then delve further. 92015 - Deduction of Interest Expense and Recognition of Interest Income for Loan Transactions between Related Persons.

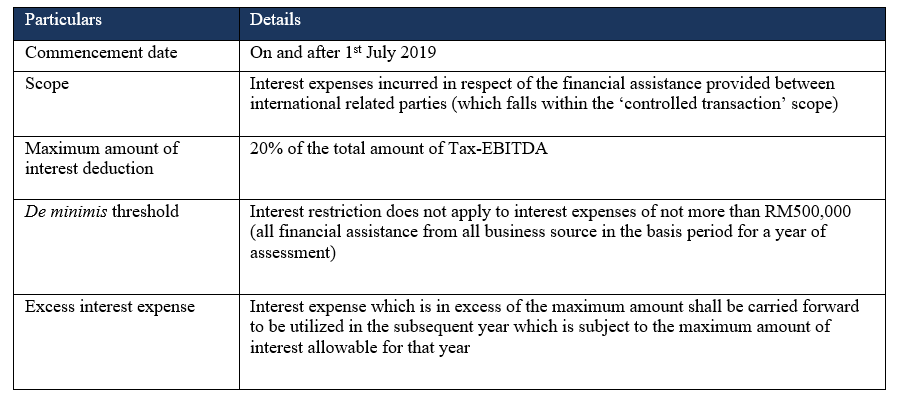

In Malaysia ESR is effective for basis periods beginning on or after 1 July 2019. The Principal Rules inter alia restrict the amount of interest that. S33 4 and 5 interest deductible when due to be paid and relevant compliance requirement.

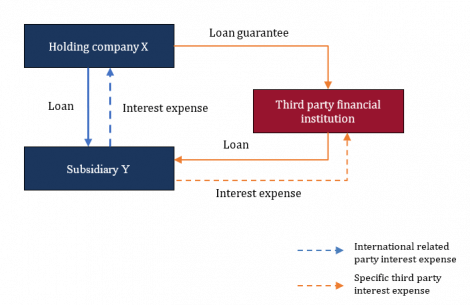

Also apply if the Malaysian subsidiaries pay interest to related parties outside Malaysia. Owns 25 shares of ABC Sdn Bhd owns 25 shares of ABC Sdn Bhd ii. Business and Non-Business Interest Restriction.

1st May 2022 Malaysia drops testing requirements for fully-vaccinated travellers and Covid-19 insurance mandate for allSource. For companies with interest expense and non-trade applications managing interest restriction can be a major issue. Gains or profits in lieu of interest 1 3.

INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No. The total cost of investments and loans which are financed directly or indirectly from the borrowed money does not exceed RM500000 subsection 33 2 interest restriction will be applied strictly based on monthly balances. Tax treatment of interest expense 1 - 3 6.

Income Tax Restriction on Deductibility of Interest Rules 2019 which is also known as earning stripping rules ESR has been gazetted on 28 June 2019. 1st April 2022 Malaysia has reopened to fully vaccinated international tourists for. The provisions relating to the tax treatment of interest expense are.

New earnings stripping rules. Income Tax Restriction on Deductibility of Interest Rules 2019 PUA. The Income Tax Restriction on Deductibility of Interest Rules 2019 PUA 1752019 Principal Rules have been amended by the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 PU A 272022 Amendment Rules which came into effect on 1 February 2022.

Section 140C is a new section in Malaysian Income Tax Act 1967 ITA introduced via Finance Act 2018 effective from 1 July 2019. On 28 June 2019 the Income Tax Restriction on Deductibility of Interest Rules 2019 were gazetted to implement the Earnings Stripping Rules ESR under Section 140C of the Income Tax Act 1967 ITA which has first been announced during the presentation of the 2019 Budget to the parliament. S33 1 general deductibility of expenses.

The earnings stripping. To tackle excessive interest deductions. In this regard.

27 July 2019. Will be subjected to interest restriction under Section 140C of the Act. Interest restriction under subsection 332 of the ITA 3 - 7 7.

Section 140C This is an ESR earnings stripping rules which implement the restriction on deductibility of interest for the following types of interest expense. Related provisions 1 4. 7 February 2011 CONTENTS Page 1.

LATEST MALAYSIA COVID-19 NEWS. 22011 Date of Issue. This webinar will first focus on the general interest deductibility rules interest restriction rules and guidelines public rulings issued by the Malaysian Inland Revenue Board.

6th May 2022 Three Thailand-Malaysia land border crossings are now open for public useSource. Interest on all forms of debt. The interest expense payable for each year of assessment year of assessment 2014 to year of assessment 2024 can only be claimed and allowed to C Sdn Bhd when the said interest is due to be paid on 3152024.

In Malaysia in computing the adjusted income for a person in a basis period of a year of assessment YA interest expenses are generally deductible against the gross income of a person provided certain conditions are metThe Income Tax Restriction on Deductibility of Interest Rules 2019 Rules has recently been gazetted and came into. Similar restrictions are called Thin Capitalisation Rules in some countries. Subsection 33 2 interest restriction will be computed based on the end-of-year balance.

Income of a unit trust in respect of interest derived from Malaysia and paid or credited by any bank or financial institution licensed under the Financial Services Act 2013 the Islamic Financial Services Act 2013 or any. Any payment of interest by ABC Sdn Bhd to ABC Co. Section 140C of the Income Tax Act 1967 ITA.

Has ordered ABC Sdn Bhd to. Or payments which are economically. As an example a Malaysian resident company which makes interest payment of RM100000 to a Labuan company is only allowed a tax deduction of RM75000 ie 75 of RM100000.

Application of the formula. See EY Global Tax Alert Malaysia releases 2019 Budget dated 4 December 2018 and EY Global Tax Alert Malaysia enacts 2019 Budget proposals dated 3 January 2019. The restriction in interest commences from the date of registration of the alienation of land by.

Another recent development with effect from Jan 1 2019 is the restriction of interest payment ie at 25 made by a Malaysian tax resident to a Labuan company. Holds a 35 stake in ABC Sdn Bhd and also owns 65 equity capital in XYZ Co. Subsequently on 5 July 2019 the Inland Revenue Board of Malaysia IRBM published the guidelines for restriction on deductibility of interest against business income ie.

Purpose of these rules As the name suggests these rules are to address the tax planning trick by which profit is being shifted. S33 1 a specific deductibility of interest expense. Interest payable for each year of assessment is to be claimed as follows.

Last published date. The bumiputra lot quota regulations under the Malaysia New Economic Policy NEP in the 1970s was introduced as a measure to increase bumiputra shares in real estate through a 30 minimum mandatory quota and a minimum 7 discount on property.

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Restriction On Tax H C Co Chartered Accountant Facebook

Restriction On Tax H C Co Chartered Accountant Facebook

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Inland Revenue Board Malaysia Interest Expense And Interest Restriction Pdf Free Download

In The Matter Of Interest Crowe Malaysia Plt

Inland Revenue Board Malaysia Interest Expense And Interest Restriction Pdf Free Download

Investing Investment Property Goods And Service Tax

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Comparing Mexico And Malaysia As Investment Destinations For Us Businesses

In The Matter Of Interest Crowe Malaysia Plt

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

In The Matter Of Interest Crowe Malaysia Plt

Inland Revenue Board Malaysia Interest Expense And Interest Restriction Pdf Free Download

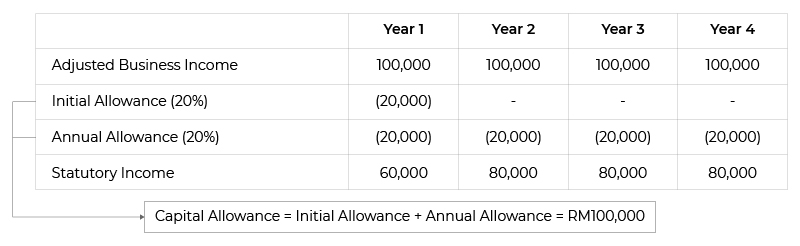

Capital Allowance Calculation Malaysia With Examples Sql Account

In The Matter Of Interest Crowe Malaysia Plt